Of course. I have updated the article to include a dedicated section on the Market Replay feature, emphasizing its value for traders. The new section has been seamlessly integrated to maintain the article’s flow and professional tone.

cTrader in Focus: The Trader’s Guide to Speed and Transparency

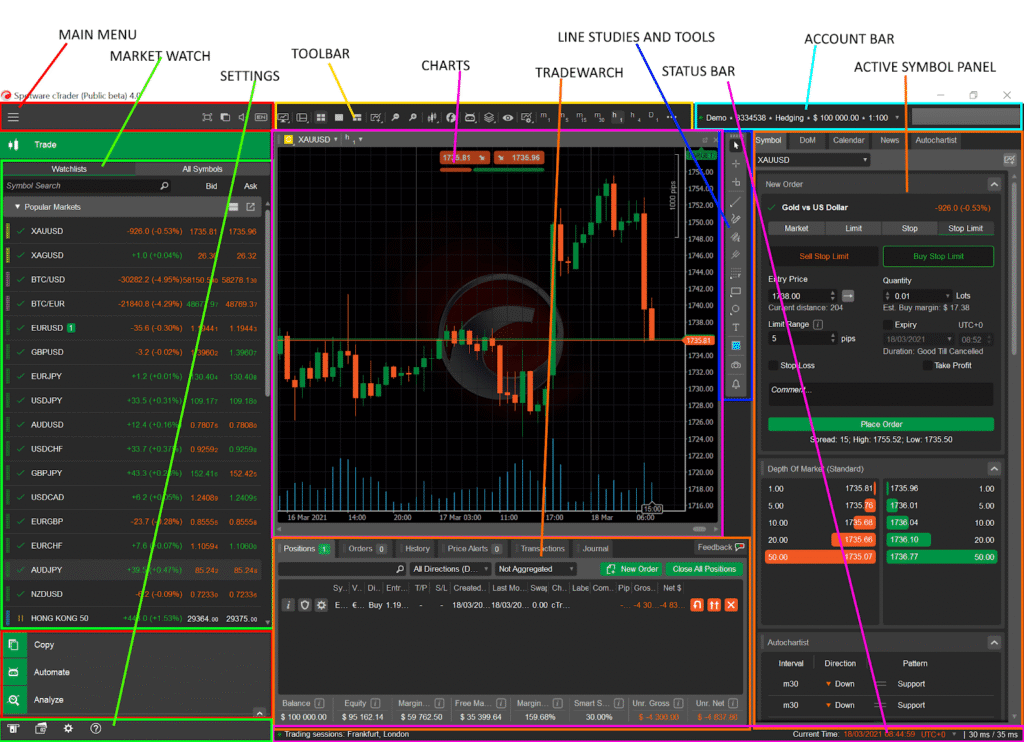

Your trading platform is your command center, the essential bridge connecting you to the fast-paced global markets. While many traders start their journey with the familiar MetaTrader, a powerful alternative, cTrader, now offers a sophisticated and user-friendly experience that is turning heads. Developed by Spotware Systems, cTrader is designed with the modern trader in mind, emphasizing transparency, speed, and advanced functionality.

This article explores the cTrader platform. We will break down its key features, see how it stacks up against the competition, and help you decide if it’s the right tool to elevate your trading journey.

What Makes cTrader Stand Out?

At its core, cTrader is an electronic communication network (ECN) trading platform. This means it provides traders with direct market access (DMA). Instead of your orders going through a broker’s dealing desk, they go straight to a pool of liquidity providers, like major banks. Consequently, this structure often leads to faster execution speeds and tighter spreads, which can save you money on every trade.

Think of it like buying a concert ticket. Using a dealing desk broker is like buying from a reseller who adds their own markup. In contrast, using an ECN platform like cTrader is like buying directly from the box office, ensuring you get a price closer to the true market value. This commitment to a transparent trading environment is a cornerstone of the cTrader philosophy.

A Deep Dive into cTrader’s Core Features

cTrader packs a suite of professional-grade tools into an intuitive interface. It caters to both new and experienced traders without overwhelming them. Let’s look at what makes it a compelling choice.

Advanced Charting and Technical Analysis

Clear, comprehensive charts are vital for making informed trading decisions. cTrader excels in this area. The platform offers a clean and customizable charting experience. You can view charts in different modes, including single-chart, multi-chart, and free-chart, allowing you to arrange your workspace exactly how you like it.

Furthermore, cTrader comes loaded with a vast library of built-in technical indicators—over 70, in fact. These tools, from simple moving averages to complex oscillators like the MACD and RSI, help you analyze market trends and identify potential trading opportunities. The platform also provides numerous timeframes, ranging from one minute to one month, giving you the flexibility to analyze price action on any scale. Drawing tools, such as trend lines and Fibonacci retracements, are also readily available and easy to use.

Unmatched Order Execution and Transparency

One of cTrader’s most celebrated features is its depth of market (DoM) functionality. The platform offers three types of DoM, providing a detailed view of market liquidity:

- Standard DoM: This shows the available liquidity at different price levels, which is crucial for scalpers and short-term traders.

- Price DoM: This view allows for more precise order placement at specific price points.

- VWAP DoM: This shows the Volume-Weighted Average Price, giving you insight into the true average price for different order sizes.

This level of transparency ensures you know exactly what prices are available for the volume you want to trade. Moreover, cTrader provides detailed order and trade history, logging every event related to your orders. This includes the time it took for the broker to fill your order, measured in milliseconds. This feature holds brokers accountable and gives you a clear picture of your trading performance.

Rewind the Market: The Power of Market Replay

One of cTrader’s most powerful learning tools is Market Replay. This feature is like having a time machine for the financial markets. It allows you to download historical price data for any instrument and replay it, tick-by-tick, as if it were happening live.

So, how does this help you? Imagine you developed a new trading strategy over the weekend. Instead of waiting for the market to open to test it, you can use Market Replay. You can go back to last week, last month, or even last year and trade through those past market conditions. You can speed up, slow down, or pause the replay at any time while placing and managing trades.

This tool offers immense value. First, it provides a superior way to backtest your strategies visually. You can see exactly how your ideas would have performed during specific events, like a major news release. Second, it dramatically accelerates your learning curve. A trader can gain weeks of “screen time” and practice in a single afternoon. Finally, it helps you build discipline and confidence by practicing your trade execution in a controlled, yet realistic, environment. It’s a step beyond a standard demo account, offering a dynamic way to sharpen your skills without risking a single dollar.

Algorithmic Trading Made Accessible

Automated trading is no longer just for institutional players. cTrader has its own native algorithmic trading solution called cTrader Automate (formerly known as cAlgo). This feature allows you to build your own trading robots (cBots) and custom indicators using the modern and popular C# programming language.

While this might sound intimidating, cTrader provides extensive documentation and a supportive community to help you get started. The platform’s code editor is user-friendly and includes features that help you write and test your code effectively. For traders who want to leverage automation without coding, the cTrader marketplace offers a wide selection of pre-built cBots and indicators.

A Unified, Multi-Device Experience

In today’s connected world, you need to be able to manage your trades from anywhere. cTrader offers a seamless experience across its desktop, web, and mobile applications. All these platforms sync perfectly with your cTrader ID (cTID), meaning your watchlists, workspaces, and settings are available on any device you use.

cTrader vs. MetaTrader: A Tale of Two Platforms

No discussion of trading platforms is complete without mentioning the industry giant, MetaTrader. While MetaTrader has long been the default choice for many brokers, cTrader presents a strong challenge.

| Feature | cTrader | MetaTrader (MT4/MT5) |

| User Interface | Modern, clean, and intuitive. | Somewhat dated but highly familiar to many traders. |

| Market Access | Primarily designed for ECN/DMA environments. | Can be used with dealing desks or ECN brokers. |

| Key Feature | Advanced Market Replay for strategy testing. | Massive library of third-party expert advisors. |

| Algorithmic Trading | Uses C# (cTrader Automate). | Uses MQL4/MQL5 (MetaQuotes Language). |

| Depth of Market | Advanced and highly detailed (three types). | Basic DoM functionality. |

| Charting | Sleek and highly customizable with many indicators. | Robust and functional, with a vast user-created library. |

Essentially, the choice often comes down to personal preference. If you value a modern design, deep market transparency, and powerful testing tools like Market Replay, cTrader is an excellent choice. On the other hand, if you want access to the largest existing library of third-party trading robots, MT4 or MT5 might be more suitable.

Who Should Use cTrader?

cTrader is a versatile platform, but it particularly shines for certain types of traders.

- Day Traders and Scalpers: These traders thrive on speed and precision. cTrader’s fast execution, tight spreads, and advanced DoM give them the edge they need.

- Technical Traders: If you rely heavily on chart analysis, you will appreciate cTrader’s sophisticated charting package and extensive range of built-in indicators.

- Algorithmic Traders: Those who prefer the widely-used C# programming language will find cTrader Automate to be a powerful and flexible tool for developing automated strategies.

- Traders Who Value Transparency & Practice: The platform’s detailed trade analysis and unique Market Replay feature appeal to traders who demand accountability and are serious about honing their skills.

Getting Started with cTrader

Beginning your journey with cTrader is straightforward.

- Find a cTrader Broker: The first step is to find a reputable broker that offers the cTrader platform. Many top-tier brokers now include it alongside MetaTrader.

- Open a Demo Account: Before committing real money, always start with a demo account. This allows you to explore the platform’s features and test strategies in a risk-free environment.

- Download the Platform: You can download cTrader Desktop directly from your broker’s website or use the browser-based cTrader Web.

- Explore and Learn: Take your time to customize your workspace, experiment with the charting tools, and test the Market Replay feature. A little practice will help you become proficient.

The Final Verdict

cTrader has firmly established itself as a top-tier trading platform. Its modern design, combined with a powerful focus on transparency, speed, and innovative practice tools, provides a compelling package for the discerning trader. By offering advanced features like Market Replay in an accessible format, cTrader empowers both newcomers and veterans to navigate the financial markets with greater confidence and precision.

If you are serious about trading and demand a platform that prioritizes your needs for speed, transparency, and skill development, then giving cTrader a try is a decision you are unlikely to regret.