MT4’s simple layout, solid charting, and a vast EA marketplace help beginners trade with confidence—learn why this enduring platform still leads.

In the fast-paced world of financial technology, a decade can feel like a lifetime. Platforms and apps rise and fall with dizzying speed. Yet, one piece of software, launched back in 2005, continues to reign supreme in the retail trading space. That platform is MetaTrader 4, often called MT4. Despite its age and the arrival of a successor, it remains the undisputed benchmark for forex traders globally.

But why has this seemingly dated platform maintained such a powerful grip on the market? The answer lies in a masterful blend of simplicity, power, and community. For beginner and casual investors, understanding MT4 is not just a history lesson; it’s a gateway to comprehending the mechanics of modern online trading. This article will demystify the platform, explore the pillars of its success, and explain why it remains an essential tool in a trader’s arsenal.

What Exactly is MetaTrader 4?

At its core, MetaTrader 4 is a trading platform. Think of it as the bridge connecting your computer to the global financial markets. It is not a broker itself. Instead, hundreds of different online brokers offer MT4 to their clients as the software to manage their accounts and place trades.

Imagine your broker is a library full of financial assets like currencies, indices, and commodities. MetaTrader 4 is the universal library card that gives you access. It provides the interface to view price charts, analyze market movements, and, most importantly, execute buy or sell orders through your chosen broker. This universal nature is a key part of its appeal. A trader can learn one platform and then use it with a wide variety of brokers around the world, making switching providers a nearly seamless experience.

The platform was developed by MetaQuotes Software and specifically designed for trading forex, CFDs (Contracts for Difference), and futures markets. Its launch revolutionized retail trading by bringing institutional-grade tools to the home computer, democratizing access to markets that were once the exclusive domain of large financial institutions.

The Pillars of MT4’s Enduring Success

MT4’s longevity isn’t an accident. It is built on a foundation of several key features that, when combined, create an unparalleled user experience, especially for those new to the complexities of trading.

Simplicity and an Intuitive Interface

Perhaps the greatest strength of MT4 is its user-friendliness. Modern software often suffers from “feature creep,” where endless updates clutter the interface and overwhelm the user. MT4, in contrast, presents a clean, logical, and surprisingly simple layout.

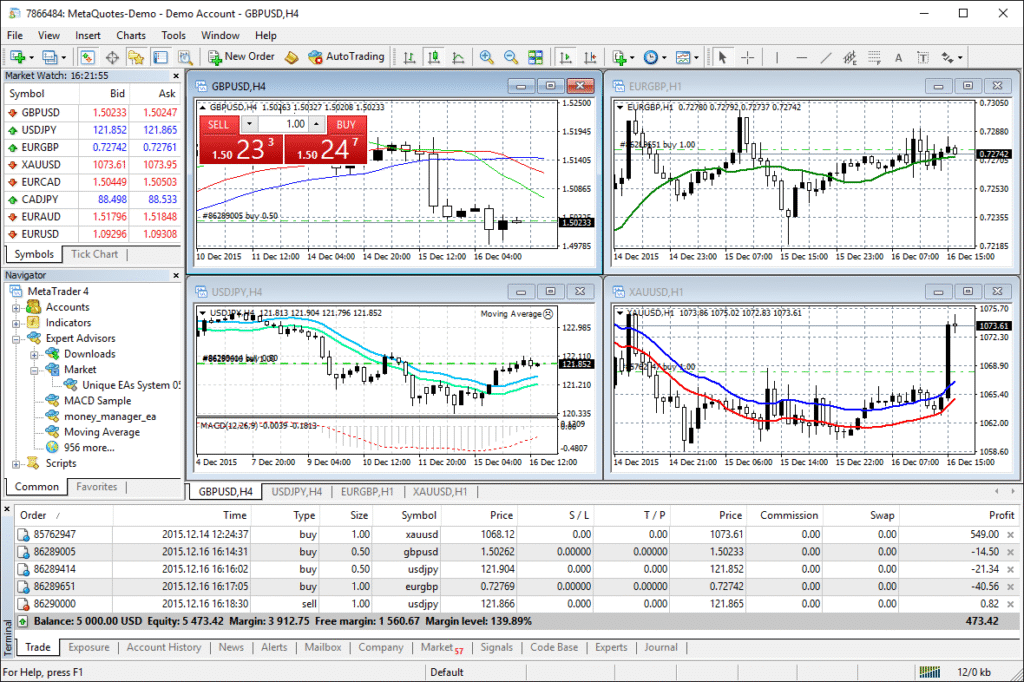

The main screen is typically divided into four key windows:

- Market Watch: A list of available trading instruments (like EUR/USD or Gold) with real-time bid and ask prices.

- Navigator: This window allows for easy access to your accounts, technical indicators, custom scripts, and automated trading programs.

- Chart Window: The heart of the platform, where you can view price charts for any asset, analyze historical data, and overlay analytical tools.

- Terminal: Located at the bottom, this section shows your open trades, account balance, trading history, and system alerts.

This straightforward design means a new trader can learn the basics—how to open a chart, add an indicator, and place a trade—in a matter of minutes. Consequently, this lowers the barrier to entry and builds a trader’s confidence from the very start.

Powerful Charting and Analysis Tools

Beyond its simple facade, MT4 hides a robust suite of analytical tools. Traders rely on technical analysis to identify patterns and forecast future price movements, and MT4 delivers everything they need right out of the box.

The platform comes equipped with over 30 built-in technical indicators, including classics like the Moving Average, Relative Strength Index (RSI), and Bollinger Bands. Furthermore, it offers a wide array of graphical tools, such as trend lines, channels, and Fibonacci retracements, that can be drawn directly onto the charts. Traders can view prices across nine different timeframes, from one minute to one month, allowing for both short-term and long-term analysis. This built-in toolkit is more than sufficient for the vast majority of retail trading strategies.

Automated Trading with Expert Advisors (EAs)

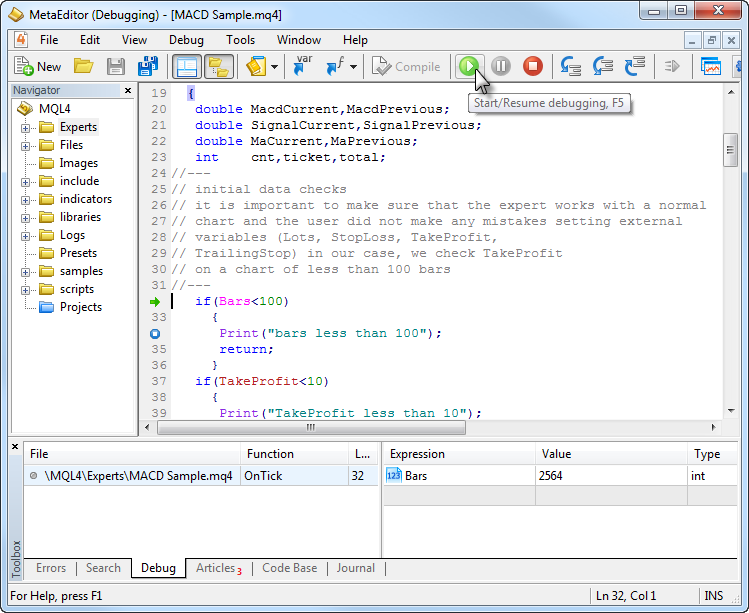

This is where MT4 truly distinguishes itself. The platform introduced the concept of automated trading to the masses through its proprietary programming language, MQL4. Using MQL4, developers can create scripts, custom indicators, and, most famously, Expert Advisors (EAs).

An EA is essentially a trading robot. It’s a program that can be instructed to automatically execute trades on your behalf based on a predefined set of rules and criteria.

For example, you could program an EA to automatically buy the EUR/USD pair whenever its 50-day moving average crosses above the 200-day moving average.

This feature allows for trading 24 hours a day without human intervention. It also removes the emotional component of trading, which is often a major pitfall for beginners. Because MQL4 is relatively simple, a massive global community has grown around developing and sharing EAs.

A Vast Ecosystem and Unmatched Customization

The MQL4 language and the platform’s open architecture have fostered an enormous ecosystem. The official MQL5 Community website (which serves both MT4 and MT5) is a bustling marketplace where traders can download thousands of free and paid tools. You can find everything from unique indicators to fully functional EAs and utility scripts.

This creates a virtuous cycle. The platform’s popularity attracts talented developers. They, in turn, create new tools that make the platform even more powerful and attractive to new users. As a result, if you can imagine a specific trading tool or strategy, there’s a high probability that someone has already built an indicator or EA for it on MT4. This level of customization is something few other platforms can match.

MT4 vs. MT5: A Common Point of Confusion

A logical question many ask is: “Why use MT4 when its successor, MetaTrader 5 (MT5), has been available for years?” While MT5 is technically more advanced, it is not a simple upgrade. It’s a different platform built for different purposes.

MT5 was designed to be a multi-asset platform capable of connecting to centralized exchanges for trading stocks and commodities, in addition to forex. It uses a new programming language, MQL5, which is more powerful but not backward-compatible with MQL4.

When MT5 launched, the vast majority of retail brokers and traders were deeply embedded in the MT4 ecosystem. The thousands of custom indicators and EAs written in MQL4 would not work on MT5. Brokers had no immediate incentive to switch, and traders were reluctant to abandon the tools they knew and trusted. Consequently, MT4 has remained the industry standard for forex and CFD trading, while MT5 has found its niche as a more versatile, multi-market platform. For a pure forex trader, especially a beginner, MT4 often remains the more practical and straightforward choice.

Getting Started with MetaTrader 4

Taking your first steps with MT4 is a simple, risk-free process.

- Find a Reputable Broker: First, you need to choose an online broker that offers the MT4 platform. Look for one that is well-regulated and has good reviews.

- Download the Platform: Once you sign up, the broker will provide a link to download their branded version of MT4. The installation is quick and easy.

- Open a Demo Account: This is the most critical step for any beginner. A demo account allows you to trade with virtual money in a real-time market environment. It’s the perfect way to familiarize yourself with the platform’s features and practice your trading strategy without risking any actual capital.

- Explore the Interface: Spend time navigating the four main windows. Open different charts, apply various indicators, and practice placing mock buy and sell orders in your demo account until you feel completely comfortable.

The Verdict: A Timeless Classic for a Reason

In an industry defined by constant change, MetaTrader 4’s staying power is a testament to its brilliant design. It achieved a rare balance: simple enough for a complete novice to grasp quickly, yet powerful enough to satisfy the demands of experienced technical analysts.

Its success was cemented by the genius of automated trading through EAs and the cultivation of a massive, active community that continuously expands its capabilities. While newer and more complex platforms exist, MT4’s unwavering focus on the core needs of the retail trader has made it a timeless classic. For anyone just starting their journey in the financial markets, there is still no better place to learn the ropes than on the trading floor of the enduring king, MetaTrader 4.

One thought on “The Enduring King: Why MetaTrader 4 Still Dominates the Trading World”

Comments are closed.